Legal System

Legal System

Legal framework and business climate. Although the law of the overseas department reduces the payroll taxes for many companies, they are relatively heavy. Production is poor and it is difficult to achieve profitability in those areas where there is more and more competition, which is not always fair. The informal economy, widespread, unemployment, do not create a serene and conducive business environment. Indeed, it is important not to forget that is France you do not have the right to succeed honestly. The developer, imbibed with stress, is a danger-administrator who spends his time in solving problems, in hiding his success, ephemeral, to be against all the responsibilities, even those which come from third parties, especially if it concerns officials. Tax persecutions are part of the arsenal of repression. In this “Calm France “, now the entrepreneur is often in the position of an “economic hostage” more than being a benefactor.

TAX AGREEMENTS France is bound by a tax convention for double taxation with many countries to avoid double taxation and to establish rules of reciprocal administrative assistance with respect to taxes on income and inheritance, rights for stamp duty and registration.

TAXATION

Tax benefits for companies: 2/10

Social charges: 2/10

ICT Development: 9/10

Main industries: machinery, food processing, transportation, aerospace, services, chemical, metallurgy, textile

Large companies present: Total, Axa, Carrefour, Vivendi Universal, Peugeot, EDF, France Telecom, Renault

Corporate tax

Tax rate of resident companies. The basic rate of corporate tax is 33.33 % plus a temporary additional contribution of 3 % or 34.33% for 2004. There is an additional social contribution of 3.3 % on tax (with an allowance of € 763,000) in the case of companies having more than 7.63 million euros of turnover or those which are not held for at least 75% by private individuals. Conversely, for companies having less than 7.63 million euros of turnover and which are held at 75 % or more by private individuals, there is a reduced rate of 15 % on the first part of the taxable income up to the limit of € 38,120.

Taxation of long term capital gains. Since 1 January 1997 the rate on net capital gains in the long and short term businesses is subject to corporate income tax rate which is aligned with the IS; however, there is a “basic rate reduced” by 19% in the case of long- term capital gains (2 years + ) on sale of equity securities and securities of venture capital, which are generally taxed at 19% ( plus 3% surcharge x 19 % for 2004 and 3.3% x 19 % for larger companies ) , 15 % for companies with turnover less than € 7,630,000.

Tax rate on branches. Under some reserves, the subsidiaries and the branches are taxed in the same way as French company. Only a few differences characterized the branches to the fact that they lack independent legal personality.

Taxes on income Tax Year. The fiscal year begins on January 1 and ends on December 31 of the same year.

Income tax rate. Scale for taxation 2002:

- From 0 to € 4,121: 0%

- From 4121-8104 EUR: 7.5%

- From 8104 to 14264 EUR: 21 % ·

- From 14,264 to 23,096 EUR: 31%

- From 23,096 to 37,579 EUR: 41%

- From 37,579 to 46,343 EUR: 46.75 %

- Above € 46,343: 52.75 %

- Are there any deductions or other tax reduction for individuals?

- Two reductions of 10 and 20% will apply to income in wages and pensions. The taxable income of an employee stood at 72 % of reported net income. Tax deductions (e.g. donations to recognized charities in the public interest, acquisition of an LPG vehicle, and subscription to shares of newly established companies…) can then be removed from the amount payable.

- VAT rate

- Standard rate: 19.60%

- Reduced rate:

- The reduced rate is 2.1 % or 5.5%

- The reduced rate of 5.5 % applies to basic goods including the daily food items.

- The reduced rate of 2.1 % applies to pharmaceutical products and to the press.

- Other taxes:

- Dock dues: Indirect tax of 4% applicable on imports and on local production. It is the first tax revenue of municipalities.

- The annual flat corporate tax (IFA) is due to any company or legal person liable to the tax on companies, existing on January 1 of the tax year and whose turnover plus financial income exceeds EUR 76,000.

- The scale is progressive: it varies between 750 and 30,000 euros.

- Tax on corporate tourists vehicles:

€1,130 of tax for the 7cv cars and less than €2,440 for the 8cv or plus.

Professional tax

The professional tax is abolished on the 1 January 2010 but was soon replaced by the territorial economic contribution (CET) which is composed of land premium enterprise (CFE), which incorporates many of the provisions that were applicable until now to the professional tax and the contribution of the value added for enterprises (CVAE) that replaces the minimum business tax contribution. These two taxes are added to the local tax on outdoor advertising (PELT). It is charges on the value of the fixed assets. The rate varies by municipality and some believe their companies make too much money and ignore a competitiveness pact, ignoring the existence of an entrepreneurial population genocide constraints per thousand, to put the key under the door. The number of businesses flying the flag “rent” has amplified in these recent years. However, town halls with little concern regarding the sustainability of the economic fabric, of enhancing the decoration of their city, prefer to see the development of the “dreadful graffiti” on their facades and walls, rather than dynamic signage, also working to provide jobs, taxes! This tax on advertisements proves disadvantageous, unfair and discriminatory and is a reflection of the French spirit who is not interested in and do not like the businesses. We see where it takes us…. in a chaos. The solidarity tax on wealth (ISF) is an annual tax payable by individuals who are resident in France, or who own property, and whose heritage has a net value exceeds € 720,000 on 1 January of the year 2002. The rate varies between 0 and 1.80% of the net assets of the taxpayer.

Inheritance tax: 5% to 60%

Donations : 5% to 60%

Local taxes: The rate is variable depending on the municipality. And saying that our French politics asked for a tax harmonization… from the Europe!

FINANCE

Accounting regulations in France is essentially determined by the State and its institutions, even if the accounting professional bodies, representatives and experts from the professional circles are closely involved in the setting process of the accounting standard. The accounting framework in France is determined by the action of several players: the Parliament, the Government, the Committee of Accounting Regulations (CRC) and the National Accounting Council (CNC). The main source of accounting regulations in France is the Accounting Act (Act 83-353 of 30 April 1983), incorporated in the Commercial Code (Articles 8 to 17, now Articles L 123-12 to L123-28 in the new Code of business). Supplemented by Law No. 89-1008 of 31/12/1989 concerning the simplified scheme for small businesses, the accounting law transposed at national level, the recommendations of the 4th Directive. The second major source of the French accounting law is that of 85-11 of 01/03/1985 which applies to domestic law the provisions of the 7th EU Directive for corporate groups (consolidated accounts).

General principles of the accounting structure

All businesses must present their accounts in accordance with the General Accounting Plan (PCG). The PCG is published by the Committee of Accounting Regulations (CRC); revised several times, the latest version dates from 1999. The significant accounting policies are set out in Titles 1 and 2 of the PCG. These principles include the consistency of methods, the historical cost, the principle of non- compensation, the precautionary principle, the continuity of the activity, the principle of independence and sincerity. The annual accounts must be “regular, sincere, and give a fair view of the assets, financial position and results of the company” (Art. 123-14, C.Com).

Obligations and publications

Any physical or legal person having the qualities of the trader, the legal persons from the private law, non-trader, who have an economic activity of a certain size must establish their accounts. Business enterprises must annually publish their financial statements. For listed companies, the publication should be quarterly. The financial statements usually include financial statements, cash flow statement (required for consolidated financial statements), the management report and the audit report. The annual accounts comprise of the balance sheet, the income statement and an appendix: they form an indissoluble asset. Business obligations relating to the publication of their accounts depend on their legal form. The accounts can be set in three forms:

- Basic System – Normal

- Speed System – For small companies

- Developed system

Moreover, the European Directive of 19 July 2002 obliges all European companies listed on the stock exchange to be established from 2005, their consolidated annual accounts on the basis of IAS. Specifically, the corporate boards of German listed companies and the German subsidiaries consolidated by German listed companies or companies listed in national law of another Member State are, from the fiscal year beginning 1 January 2005 or after that date, in 2006 systematically confronted with established consolidated accounts according to IAS / IFRS and therefore different in form and in content from those they have received so far.

- Certification and auditing

- Account Control is mandatory for listed companies and for large companies.

- Professionals and representative organizations

The Superior Council of the Institute of Chartered Accountants (OEC) defends the collective interest of the profession of chartered accountant and has nearly 17,000 members. The National Company of Statutory Auditors (CNCC) represents the interests of 17,000 French Statutory Auditors.

CUSTOMS REGULATIONS – EXPORT-IMPORT

Under its accession to the European Union, France applies the Community regulations which are valid throughout the Union. If the EU has a trade policy liberal enough, there are a number of restrictions, especially in agricultural products, following the implementation of the CAP (Common Agricultural Policy): the application of compensations to import and export of agricultural products to promote the development of agriculture within the EU, implies a certain number of control and regulation systems for the goods entering the EU territory. Moreover, for sanitary reasons, as regards the presence of Genetically Modified Organisms, if they are allowed in the European territory, their presence should be systematically specified on the packaging. Beef having a high rate of hormones is also forbidden for exportation. The BSE crisis (disease called “mad cow”) urged the European Authorities to strengthen the phytosanitary measures to ensure the quality of meats entering and circulating in the EU territory. The principle of precaution is now widespread: in case of doubt, the import is prohibited until proof of the harmlessness of the products is demonstrated.

Customs

Since 1 January 1993, the European Union, which includes France, formed a single market without internal frontiers within which ensures the free movement of most of the goods. Some goods remain prohibited or subject to special formalities. This is e.g. drugs for human use, waste, plants or live animals. On 1 May 2004, 10 ” accession countries ” have joined the European Union: Estonia, Hungary, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Slovenia, Malta and Cyprus. The trade of goods, within the European Union, originating in one of the 25 Member-States is totally free from customs duties. This trade consists of delivery and intra-Community acquisitions and not for exports and imports. Nevertheless, when introducing goods from within the Community in France, the exporter must fill at the end of the month a Declaration of Exchange of Goods (DEB) or an Intrastat Declaration. On the entry of goods from non-European origin in the French market, the customs duties are calculated Ad valorem on the CIF value thereof, in accordance with Common Customs Tariff (CCT) to all European countries. While the principle of free movement of goods constitutes the internal dimension of the customs union, the TDC constitute the external dimension as it enables to apply uniform customs duties to products imported from the third countries, irrespective of the destination of the State. Fees for non-European countries are relatively low, especially for industrial products (4.2 % on average for the general rate), however the sector of fabric, clothing items (high duties and quota system) and food (average duty of 17.3 % and numerous tariff quotas, PAC) still know protective measures. Conveniently, it is the TARIC code (10 digits) which sets the rate of customs duties and the applicable Community rules on import of a product originating in a country not belonging to the European Union. For knowing the customs duty of a product according to its country of origin, the TARIC database must be consulted. Moreover, many multilateral and bilateral agreements signed by the European Union define and reduce tariffs to entry, including: customs cooperation agreements with Australia, Canada, USA, Mexico and South Korea:

- The EU – EFTA agreement (European Free Trade Association) signed in 1972 and which led to the gradual disappearance of the customs right’s, particularly for industrial products between the EU on one hand and Iceland, Liechtenstein, Norway and Switzerland on the other.

- Free trade agreements with Romania and Bulgaria, which could join the EU in 2007. At present, trade in industrial products between the EU and these two candidate countries are not subject to the customs regulations.

- The Mediterranean agreements concluded with: Turkey ( 31.12.1995 – Customs Union for industrial products only) , Israel (July 2000) , Jordan ( 07.01.1977 under renegotiation ), Morocco ( 18.3.2000 ) Palestinian Authority ( 1.7.1997 ), Tunisia ( 03/01/1998 ), Egypt ( 07/01/1977 ) , Lebanon ( 07/01/1977 ) and Syria ( 07/01/1977 ) .

- The ACP agreements, with 95 % of tariff lines to 0 % for countries in the process of development like Africa, the Caribbean and the Pacific. The Cotonou Agreement, signed in 2000, defines the new EU-ACP relationship.

- The Generalized System of Preferences (GSP): 54 % of tariff lines are at 0 % for developing countries outside the ACP.

Standards and intellectual protection

-

- AFNOR (the French Association for Standardization is the competent authority in the matter). AFNOR prepares and revises standards at the request of public and submit them to the relevant ministry for approval. Copies of the new standards can be obtained from this organization.

- Compliance with the standards is mandatory for compliance with the standards of all products such as machinery, tools, home appliances, sports equipment, toys, etc. For other products standards compliance is generally optional. The technologically complex or potentially dangerous goods must undergo rigorous testing and approval procedures before being marketed in France. Although the purpose of the European Union is to harmonize standards to all EU countries, most of these standards are still at a stage of development. France is often being accused for the complexity of its standards and slow procedures in place for testing.

- There is a significant growing demand for ISO 9000 certification by the enterprises. But this certification is not currently mandatory in France and Europe, being certified ISO 9000 is primarily an asset. This is the Laboratoire National D’Essai who makes the tests and is able to issue the certificates.

Business Climate & guarantees

-

-

- The French economy is “known” to be very open to international trade. France is classified second after Germany in terms of foreign trade.

- Its top three import partners are: Germany, Italy and Belgium, while its three main export partners are Germany, Spain and Italy.

-

France imports mainly oil, machinery and equipment, vehicles and consumer goods. The risk of decay and inefficiencies of administration – irresponsible – are important, and are never recognized. This would have a tendency to grow dangerously.

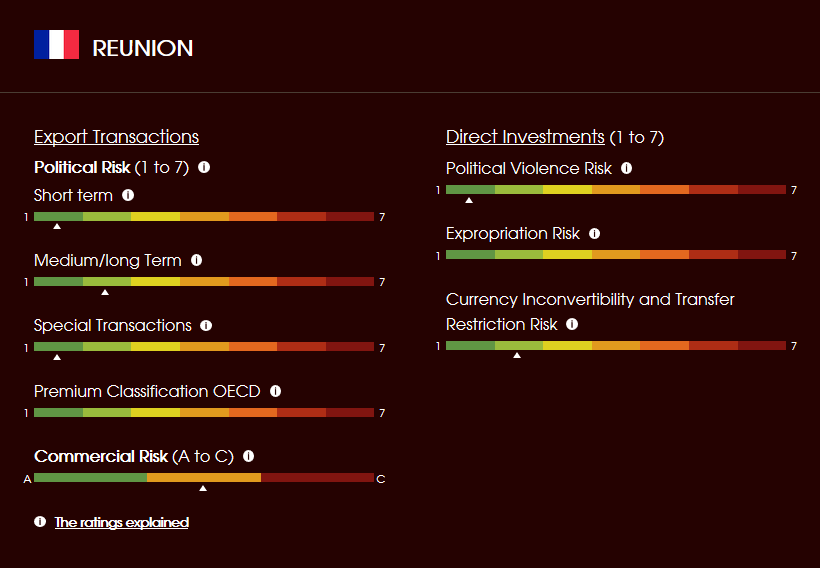

Risk Management

Risk Management

Labour disputes and strikes are very common and make the Island lost huge sums of money each year. The ‘developers’ are regularly taken on hostage. Nobody seems to be offended from this trend where, over the years, continues to worsened and discourages some more initiatives. It swells the flood of bankruptcies, and for ten years the trend is accelerating, 2013 is a great vintage, 2014 could be even better… SYNOPSIS DAMAGES, LOSSES AND OBSTACLES TO EVIDENCE AND PROTECTION – Warning Phone

Warning

Warning

Being entered

Tales and misadventures

Tales and misadventures

Being entered

Numbers and useful links

Numbers and useful links

Social Security: 0262 40 33 40

Weather Forecast: 0892 68 08 08

Cyclone Info: 0897 65 01 01

EDF: 0262 40 66 00

Directorate of Veterinary Services of Reunion

Address: Providence Park 97488 Saint- Denis Cedex

Phone: 02. 62. 30. 88. 20

Fax: 02. 62. 30. 88. 30

Our Sense

Our Sense

Being entered